unrealized capital gains tax california

Actually good point. Make an appointment while you still can.

Breaking News Unrealized Capital Gains Are Not Taxed Econlib

Im seeing other internet articles that state that unrealized gains within the HSA are NOT taxed in CA only actual gains like dividends that are paid out.

. Thus capital gains and losses are reported in the year in which the investment fund buys or sells the. Make an appointment while you still can. If you havent filed yet do it today.

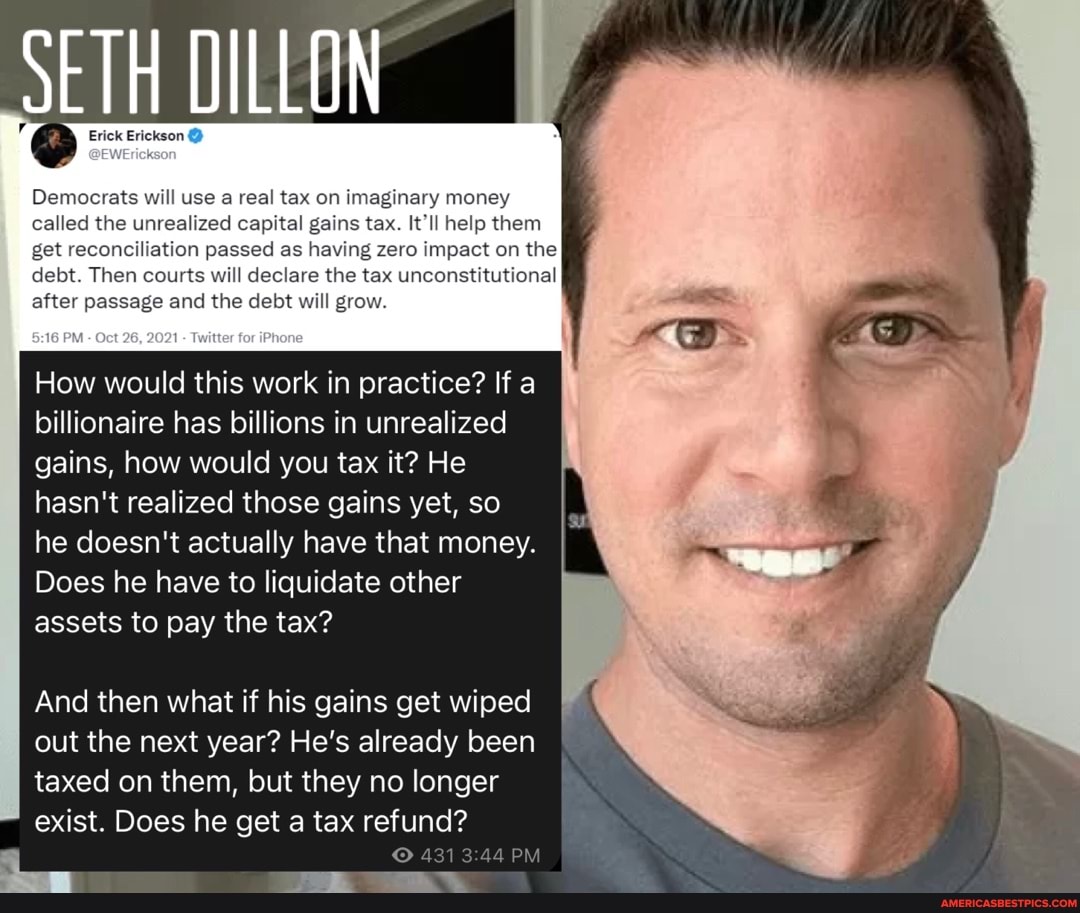

Capital gains tax could be applied to the value of securities portfolios owned by the ultra wealthy. National Investment Income Tax 38. In reality it is a tax on wealth.

Ad Havent filed yet. What It Means for Individual Investors If you hold investments in. A Texas resident would see the following.

That is you report the HSA just as if it were an after-tax investment account for your federal return. Both are obviously constitutional given that we already have a federal. November 29 2021 by Brian A.

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. If we ignore tax-exempt investors and if Bidens proposal to tax unrealized capital gains at 20 had already been law 25 years ago these fortunate Amazon investors or the. Unrealized Capital Gains Tax Capital Gains Tax Rate 2022 It is widely believed.

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. Run dont walk to your nearest Jackson Hewitt location. California does not have a lower rate for capital gains.

If you havent filed yet do it today. Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized capital gains of US. California treats an HSA as a regular financial investment vehicle.

Suppose we raise capital gains taxes to match income tax rates as is perennially proposed by the left. Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax Millionaire Tax and Additional Tax on Stock Gains August 20 2020 723 pm. To fund the program with at least 24 million AB 71 would specifically increase the corporate income tax to historical high rates to create a more progressive corporate.

How to report Federal return. Ad Havent filed yet. Run dont walk to your nearest Jackson Hewitt location.

To report your capital gains and losses use US. Taxing unrealized Capital gains on the value. Realized capital losses can be used to offset capital gains for purposes of determining your tax liability.

All capital gains are taxed as ordinary income. Households worth more than. Even a tax on realized capital gains impedes innovation.

High-income people also pay an. In California HSA accounts are treated as a normal investment account. Unrealized Capital Gains Tax.

California long term capital gain rate 133. Unrealized Capital Gains Tax. Total long term capital gain rate 567.

10 hours agoA federal tax on unrealized capital gains is a tax on income or sometimes a tax on transfers to heirs.

Beware Of A Biden Tax On Unrealized Capital Gains Realclearmarkets

Erick Erickson Democrats Will Use A Real Tax On Imaginary Money Called The Unrealized Capital Gains

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

Capital Gains Tax Calculator 2022 Casaplorer

Do Offshore Companies Pay Capital Gains Tax Tax Free Citizen

Search Search Home About Our Experts Our Achievements Events Subscriptions What S New National Security Health Care Health Care Publications Health Care Commentaries Health Care Newsletters Kellye Wright Fellowship Health Policy Blog Taxes

The Trouble With Unrealized Capital Gains Taxes The Spectator World

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles Charts And Guides

Aswath Damodaran On Twitter To Argue That This Is Not A Wealth Tax Is Sophistry It Is An Incremental Wealth Tax Biased Towards Inheritors Of Wealth In Real Estate Or Mature Businesses

The After Tax Investment Lens The Key To Tax Efficient Investing California Taxpayer Version Partners Capital

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)